Western Circle Group

Fintech innovation engineered for the UK financial market. We build proprietary AI technology at the core of a fully integrated lending ecosystem, where advanced decisioning and proven direct-lending brands operate in perfect alignment.

We Solve One Problem — Safe, Intelligent Access to Money

For over a decade, we’ve built and refined proprietary fintech systems that deliver fast, fair, and fully regulated access to short-term capital in the UK.

Our platform isn’t a plug-and-play solution or a generic lending engine — it’s a purpose-built financial technology ecosystem engineered to evaluate risk, protect consumers, and operate seamlessly within the UK’s strict regulatory framework.

What sets Western Circle Group apart is the science behind how we deliver instant access to money for more people in the UK. Our proprietary AI models analyse behavioural, financial, and regulatory variables in real time, allowing us to make precise, compliant decisions within seconds. This technology enables safe lending at scale, without compromising accuracy or consumer protection.

This blend of innovation, compliance, and responsible design is why Western Circle Group has led the UK short-term finance market for more than 10 years. We don’t just provide funds — we provide a reliable financial infrastructure that supports people when they need it most.

Why Have Over Half a Million People Chosen to Work With Us?

Providing money at scale may seem simple, but doing it safely, responsibly, and instantly for hundreds of thousands of people requires exceptional technology and deep human insight. Our products and brands are built to support individuals during life’s unexpected moments by delivering fast, dependable access to essential funds without the delays, barriers, or rigid requirements of traditional banking..

Behind every transaction sits a sophisticated infrastructure — proprietary AI models, compliance-driven automation, and operational systems refined over more than a decade. These technologies allow us to treat money as a reliable, accessible commodity for millions, while maintaining the fairness, accuracy, and regulation demanded by the UK market.

At the same time, we never lose sight of the people we serve. Financial emergencies are stressful, and our mission is to reduce that pressure through clarity, transparency, and support. Since 2014, our customer care team has remained consistently available through email, calls, SMS, WhatsApp, and live chat — ensuring individuals are never left without guidance when it matters most.

This unique combination of advanced fintech engineering, regulatory mastery, and genuine empathy is why over half a million people have chosen Western Circle Group — and why our model continues to stand out in the UK financial landscape.

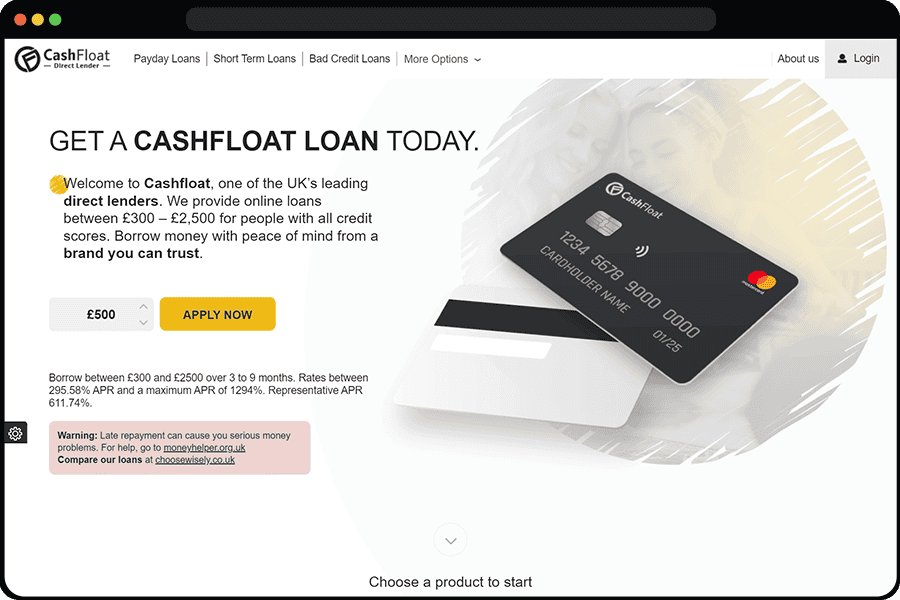

Our Lending Brands

Western Circle Group operates a portfolio of lending brands across the UK, each designed to meet the needs of different customers, credit profiles, and financial circumstances. While every brand serves a unique segment, they are all powered by the same proprietary technology that has set us apart in the UK market for more than a decade. Our decisioning engine, risk systems, and compliance framework can be fully customised to support a wide range of credit products — all with rigorous adherence to FCA regulations and responsible lending standards.

The strength of this platform is exactly why we chose to deploy it exclusively across our own direct-lending brands.

By keeping the technology in-house, we ensure that its full value flows into our operations, our customer experience, and the long-term performance of our portfolio.

The great advantage

For investors, Western Circle Group represents a rare opportunity in the UK financial market: a fully integrated ecosystem where proprietary fintech technology and established direct-lending brands operate in perfect alignment. This vertical integration creates operational efficiency, regulatory strength, and a competitive moat that is exceptionally difficult to replicate.

At the core of this advantage is our decisioning engine — a system engineered to analyse complex behavioural, financial, and regulatory data in real time. These insights enable rapid, accurate, and responsible decisions at scale, benefiting both lenders and borrowers while preserving the highest compliance standards.

This fusion of technology, regulation, and proven market execution is what turns our platform from a lending operation into a long-term asset. It is not simply a system that processes loans — it is an adaptable financial infrastructure built for durability, growth, and sustained market leadership.

Learn More